Summary

For ALL Members who participate in the Group Insurance AND/OR Disability Income Plan(s), the Group Insurance Plan & Disability Income Plan Leave of Absence & Layoff Form (Form #44) MUST be completed and submitted to the MEBP Administration Office prior to the start of the any unpaid leave of absence or layoff period.

A Member of the Group Insurance Plan MEBP and/or Disability Income Plan may elect to contribute to the Plan(s) and retain coverage while off work due to an approved unpaid leave of absence or layoff. If the leave of absence is a paid leave, contributions automatically continue to be made through payroll deduction.

If the Member elects not to continue to contribute to the Plan(s) during the period of unpaid leave of absence or layoff, THEIR GROUP INSURANCE AND/OR DISABILITY COVERAGE CEASES until they return to work and contributions recommence. Required contributions MUST resume immediately when the Member returns to work.

If the Member elects to continue to contribute during the unpaid leave or layoff, please refer to the Contributions to be Paid During Unpaid Leave of Absence or Layoff section of this Manual to determine the amount of contributions to be paid. The Member is required to contribute both the Employee and Employer required contributions and is to provide postdated cheques, made payable to the Employer, who will report the payments on their monthly MEBP Remittance Statement each month.

NOTE: Should the Member be on a medical leave for 60 days or more and it appears they may not return before 18 weeks (126 days), they may be eligible to apply for Disability Income. For further information please refer to the Disability or Workers Compensation Leaves section of this Manual.

There are limits on the length of time that Group Insurance Plan contributions will be accepted by MEBP. The time limits are as follows:

| Type of Absence | 12 months | 24 months | Other |

| Layoff Lockout/Strike Parental Maternity Personal Educational/Professional Compassionate Care |

x x |

x x x |

17 weeks 63 weeks |

| Sick/Injury, Workers Compensation and Manitoba Public Insurance A Member who is off work due to sickness or injury (includes Manitoba Workers Compensation & Public Insurance), can continue to pay for coverage under the MEBP Group Insurance Plan until the earliest of the following:

|

|||

IMPORTANT: Workers Compensation (WCB), Manitoba Public Insurance (MPI) or other LTD Plans (not with MEBP)

If a Member of the MEBP Disability Income Plan and Group Life Insurance Plan, is off work due to a WCB, MPI or another disability income plan claim and it is anticipated that the leave will be greater than 18 weeks, please contact the MEBP Administration office. The Member may be eligible for Waiver of Coverage under Basic Life Insurance.

Employees who do not participate in the MEBP Disability Income Plan, but are receiving benefits from WCB, MPI, or any other disability income plan, have the option to continue to pay for coverage under the Group Insurance Plan if they are a Member of that Plan. Members are required to pay the total required contributions.

Contributions to be Paid During an Unpaid Leave of Absence or Layoff

If the Member wishes to continue with contributions while off work, the cost of the required contributions are calculated by the Employer and are based on the Member's insurance benefits, coverage amounts and contribution rates in effect prior to the start of the leave or layoff. The coverage amount(s) cannot be changed while the Member is on a leave of absence or layoff. Basic Life insurance contributions must be made in order to continue Optional Life, Voluntary AD & D and Family Life coverage.

Example Calculation:

Jane will be on a leave of absence for a total of 15 pay periods. She and her employer have completed Form #44. Jane has chosen to pay for her Group Insurance Plan and Disability Income Plan contributions while away from work. She decides to pay for Basic Life only, even though she participates in Family Life and Voluntary AD&D. Her employer provides the following information:

Number of pay periods that Jane will be on leave: 15

Total Number of pay periods in the current year: 24 (semi-monthly payroll)

For Basic Life Insurance Contributions:

Group Insurance contributions during a period of unpaid leave or layoff are determined based on the Member’s coverage amount(s) in effect prior to the start of the leave or layoff.

Jane’s Basic Life coverage (based on 2 units) prior to leave: $70,000

Basic Life contribution rate prior to leave: $0.19 per $1,000 of insurance per month.

Cost to continue with contributions = $70,000/1000 x $0.19 x 12 months = $159.60 per year for Basic Life

$159.60/24 pay periods = $6.65 per pay period

$6.65 x 15 pay periods of leave = $99.75 total cost

For Disability Income Plan contributions:

Disability Income Plan (DIP) contributions during a period of unpaid leave or layoff are determined based on the Member’s pre-disability earnings.

Pre-Disability Earnings are:

For full-time employees – earnings the amount equal to all the basic annualized remuneration which a member receives from the Employer for the position regularly occupied by the Member on the day preceding the day on which Total or Partial Disability occurs: These annualized earnings will be divided by 12 to determine the monthly earnings.

For part-time, seasonal members – means an amount equal to the highest of the Member’s earnings in the year of application or in the preceding two calendar years. These earnings will be divided by 12 to determine the monthly earnings.

Jane is a full time employee. Her Annual Salary in effect on the day preceding her leave is $35,000 per year. The current DIP contribution rate is 1.60% (prior to January 1, 2024 it was 1.7%).

Example of the DIP contribution calculation for a Part time or Seasonal employee:

| The highest earnings in the year of application* or the in the preceding 2 calendars years* | X | DIP rate | = | Annual DIP contribution owing |

For this example, this part time Member’s earnings were:

In year of application to date of leave: $ 7,500.00 = $18,000 annualized (see example below*)

Preceding Calendar year 1: $28,700.00 – highest year

Preceding Calendar year 2: $27,700.00

Number of pay periods that Jane will be on leave: 15

Total Number of pay periods in the current year: 24 (semi-monthly payroll)

Disability Income Plan Contributions during period of leave are:

$28,700.00 x 1.60% = $459.20 per year

$459.20 / 24 pay periods = $19.13 to be deducted per pay period

Total DIP contributions to be paid for period of leave: $19.13 x 15 pay periods = $286.95

*if the Member doesn’t have at least one full calendar year of service – annualize the partial years earnings based on number of months worked. Example: Employee started to work February 1st and went on Leave June 31st. During the 5-month period from February to June, the Employee’s earnings were $7,500.00. Therefore, these earnings annualized for a full year are $18,000 ($7,500 / 5 months X 12 months)

Jane’s current DIP contribution is $560.00 per year ($35,000 x 1.70%). $560.00 / 24 pay periods = $23.33 per pay period.

Jane is on leave for 15 pay periods, DIP contributions to be paid for period of leave is: $349.95 total cost

Contributions on Top Up Pay

If the Member is off work and receives only top up pay, MEBP contributions are not required to be deducted. If the Member is off work due to WCB claim but continues to be paid a percentage of his/her earnings as well as top up pay by the Employer, then all MEBP contributions should continue to be deducted.

Contributions for a Member Called into Work While on Layoff or Leave

If a Member is called into work while on layoff or decides to work for certain periods during a leave of absence and is paid through regular payroll, then all required MEBP contributions must be deducted from their pensionable earnings.

If the Member has been making payments for the Disability Income Plan and Group Insurance Plan while on layoff or Leave, it is not necessary to take another deduction. In this case, only Pension Plan contributions should be deducted through payroll.

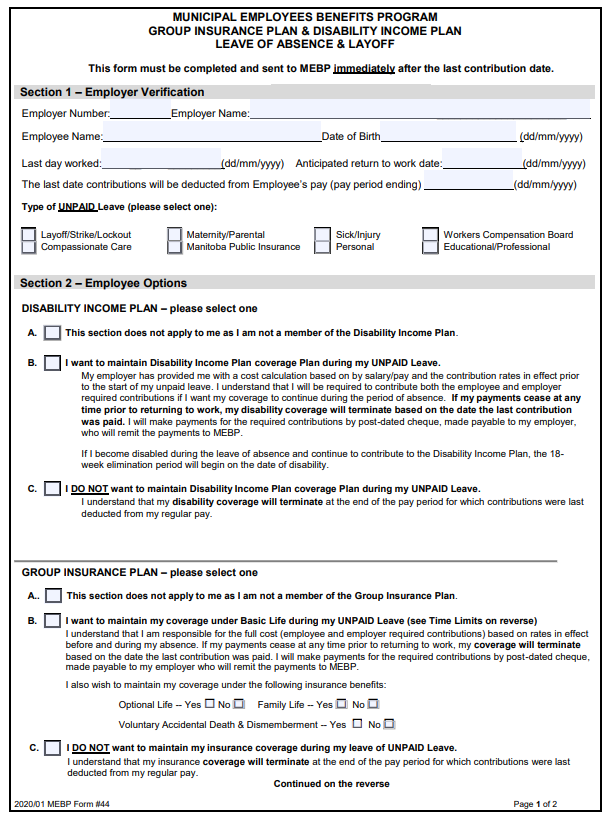

Form #44 - Group Insurance Plan & Disability Income Plan Leave Of Absence & Layoff Form

Group Insurance Plan & Disability Income Leave of Absence and Layoff Form (Form 44) must be submitted to the MEBP Administration Office prior to the start of the any unpaid leave of absence or layoff period.

Prior to having the Member complete this form, the Employer must inform the Member of the amount of contributions that are required to continue coverage during a period of unpaid leave.

Section 1 – Employer Verification: to be completed by the Employer.

Employer Number: Enter the employer number assigned to you by MEBP. It is used for identification purposes.

Employer Name: Enter the name of Employer

Employee Name: Enter the name of Employee

Date of Birth: Enter the Employee’s date of birth

Last day worked: Enter the last day worked prior to LOA.

Anticipated return to work date: Enter the date the Employee is anticipated to be back at work.

Pay period ending: Enter the end date of the last pay period the Employee made a pension plan contribution prior to LOA.

Type of Unpaid Leave: check the appropriate box.

Section 2 – Employees Options: to be completed by the Employee.

DISABILTITY INCOME PLAN (DIP)

Box A – the Employee would select this box if they are not a DIP participant.

Box B – the Employee would select this box if they want to continue their DIP coverage during their leave and pay the required contributions

Box C– the Employee would select this box if they DO NOT WANT to continue their DIP coverage during their leave.

GROUP INSURANCE PLAN

Box A – the Employee would select this box if they are not a Group Insurance Plan participant.

Box B – the Employee would select this box if they want to continue their Basic Life coverage during their leave and pay the required contributions. They would also select the appropriate box(es) in regard to Optional Life and Voluntary Accidental Death & Dismemberment Insurance coverage.

Box C– the Employee would select this box if they DO NOT WANT to continue their Group Insurance coverage during their leave.

Section 3 – Employee Declaration and Signature (page 2 of the form) - the Employee must read and sign this Section.

Section 4 – Employer Declaration and Signature (page 2 of the form) - the Employer must read and sign this Section.

All areas of the form must be completed.

THIS IS A 2 PAGE FORM. After the front is completed, the Employee and Employer are to read and sign page 2.