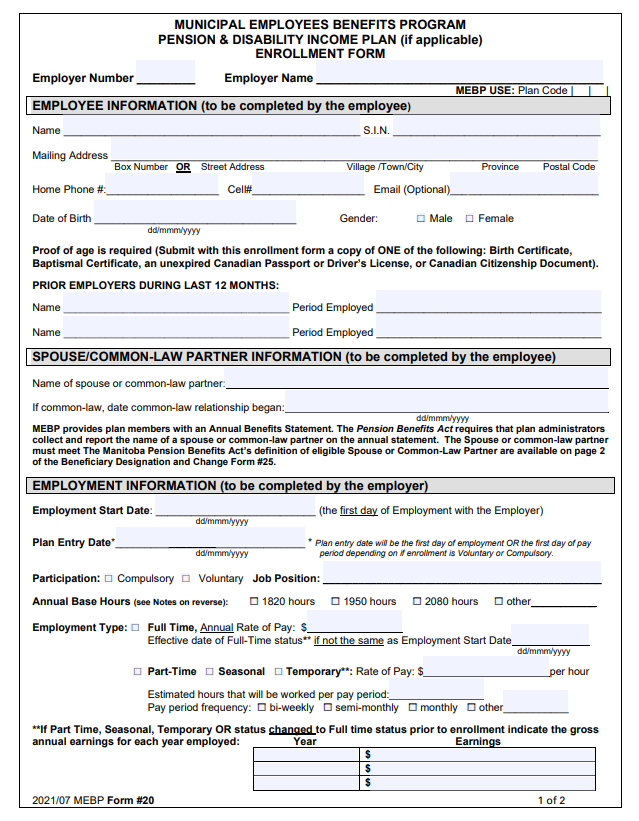

Form #20 - Pension & Disability Income Plan Enrollment Form

- Employer Number: Enter the Employer number assigned to you by MEBP. It is used for identification purposes.

- Employer Name: Enter the Name of Employer

- Employee Information Section: To be completed by the Employee. MEBP uses the Social Insurance Number when processing some transactions.

- Spouse/Common-Law Partner Information: The Employee must enter the name of his/her current Spouse or Common-Law Partner. If common-law, the date of the common-law relationship began.

- Employment Information: This section is to be completed by the employer. Employment Start Date is the employee’s hire date. This date may be modified if this employee was a full time student that previously elected to be exempt from Compulsory enrollment.

- Plan Entry Date: This is the employee’s enrollment date in the Plan(s). It is the Employer’s responsibility to ensure that ALL contributions start and are remitted based on the Plan Entry Date Stated on this form.

- Participation: Indicate if this is Compulsory or Voluntary enrollment.

- Job Position: Indicate the employee's job position as at the Plan Entry Date.

- Annual Base Hours: Choose from list provided or enter full time Annual Base Hours for this member’s current job position. See the reverse side of Form 20 for more information or refer to Part 6 – Additional Employer Information section of this manual to learn How to Determinate Base Hours).

- Employment Type: Indicate the employee’s employment status as at the Plan Entry Date. If full-time, also enter the employee’ Annual Rate of Pay at the Plan Entry date.

- If Part Time, Seasonal or Temporary, enter the hourly rate of pay, the approximated hours this employee works per week, and check the frequency the employee is paid. If the employee is Part Time, Seasonal or Temporary, you must also complete the Earnings Block. Please note: Overtime Earnings are included in the Year to Date totals to determine eligibility only. Overtime earnings are not pensionable and therefore will not have deductions taken from them.

(When an employee joins the Pension Plan, they are automatically enrolled in the Disability Income Plan (DIP), unless the employer does not participate in this plan.

Employees who are age 64 & 8 months on the enrollment date are not eligible to participate in the DIP.

All areas of the form must be completed.

THIS IS A 2 PAGE FORM. After the front is completed, the employee is to read and sign the page 2.

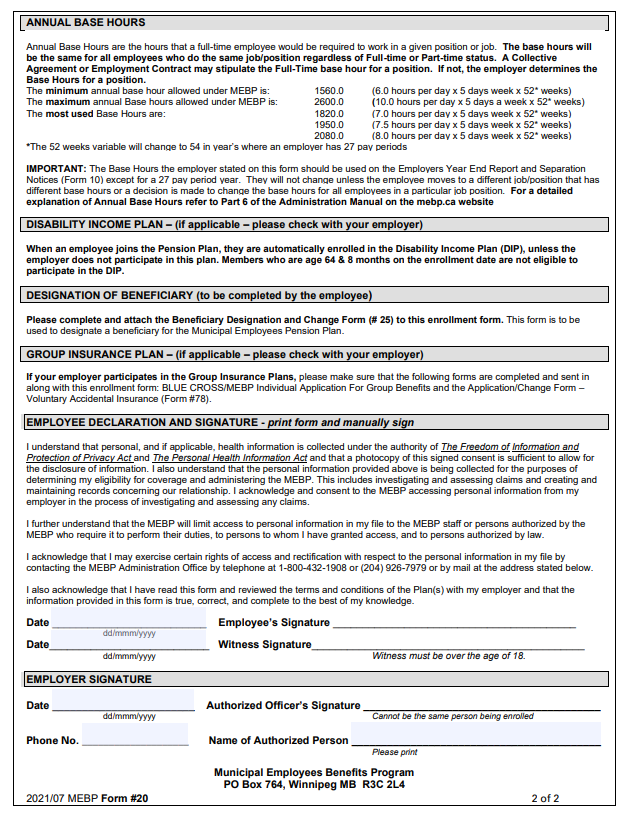

Form #25 - Pension Plan – Beneficiary Designation and Change Form

- Employer Number: Enter the Employer number assigned to you by MEBP. It is used for identification purposes.

- Employer Name: Enter the Name of Employer

- Employee Name: Enter the Employee’s Name

- SIN: Enter the employee’s Social Insurance Number. MEBP uses the SIN when processing some transactions.

- Beneficiary Information: The Employee must read this section thoroughly. Under pension law, spousal rights override any other beneficiary designation unless a Spousal Waiver is completed by the employee’s spouse.

- Beneficiary Designation: This is to be filled out by the employee.

- Please have the employee read the Beneficiary Designation Section on page 2 of the form prior to completing this section.

- Spousal rights override any other Pension Plan Beneficiary Designation. Spouses and common-law partners have legislated rights under the Manitoba Pension Benefits Act (PBA), which cannot be changed by a Will or Court Order and should be named as the beneficiary to pre-retirement death benefits. The PBA states that a pre-retirement death benefit must be paid to a spouse or common-law partner UNLESS:

- at the time of death the employee and their spouse or common-law partner, were living separate and apart due to a relationship breakdown or,

- the employee's spouse or common-law partner signed a waiver form to give up his/her rights to the pre-retirement death benefit and the waiver has not been revoked.

- If the employee’s Spouse/common-law partner wishes to Waive their right to the pre-retirement Death Benefit, the spouse/partner is required to complete Form #26 – Waiver of Pre-Retirement Death Benefit. This Waiver form can be printed directly from www.mebp.ca website or can be obtained from the MEBP office. This completed Waiver must be sent to the MEBP Administration Office.

- Trustee Designation: This is to be filled out by the employee if any of the beneficiaries listed are under the age of 18 or lack legal capacity.

All areas of the form must be completed.

THIS IS A 2 PAGE FORM. After the front is completed, the employee is to read and sign page 2.

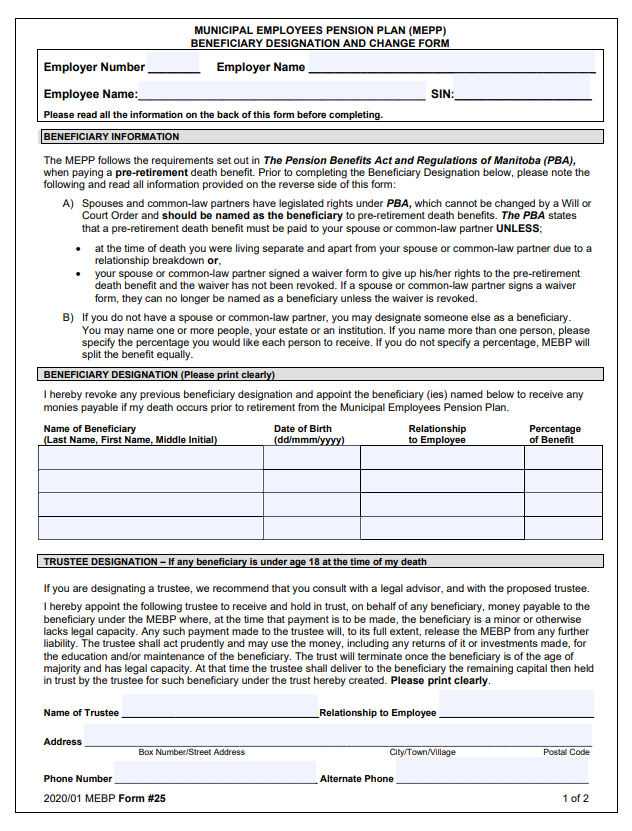

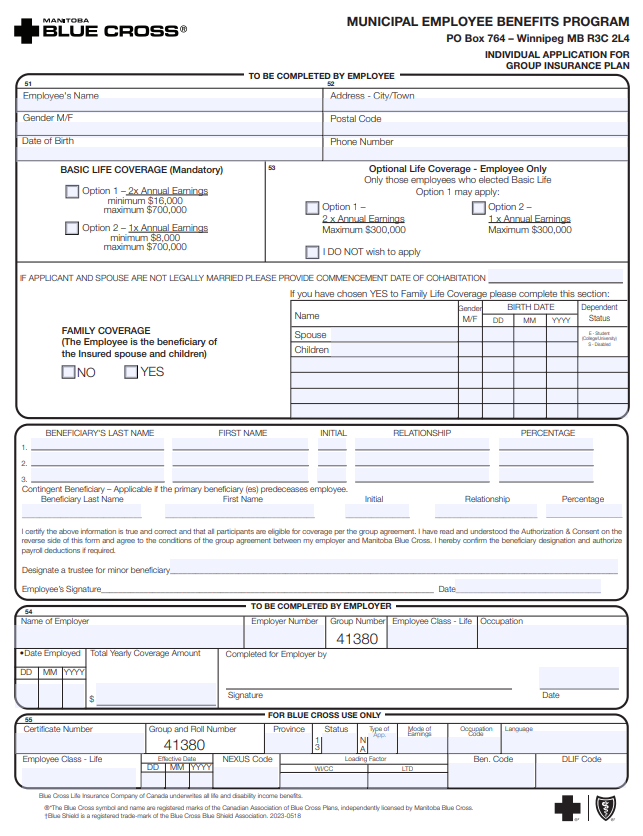

Blue Cross/MEBP – Individual application for Group Insurance Plan

- To Be Completed By Employee Section: Fill in the personal information

- Basic Life Coverage: This plan is mandatory if the employer participates in the Group Insurance Plan. The employee must choose coverage of 1 or 2 times their annual earnings. Employee is to be advised that if they want to increase coverage from 1 to 2 times their annual earnings at a later date, evidence of good health will be required. Any cost incurred in providing evidence of insurability will be at the employee’s expense.

- Optional Life Coverage – Employee Only: This is optional (voluntary) additional life insurance. The employee can apply for an additional 1 or 2 times their annual earnings for coverage or decline additional coverage. The member must mark the box applicable. Additional Coverage can only be applied for if the employee has first chosen 2 units of Basic Life coverage. MEBP office will advise of the Effective Date and Contribution for payroll deduction once it is approved by the Insurance Carrier.

- Family Life Coverage (referred to as Dependent Life Coverage on form) – This is optional (voluntary) life insurance coverage for eligible family members available to members who are under age 65 (coverage ceases at age 65). The member must choose to enroll or not. If YES is indicated, the box indicating spouse and children(s) name, gender and dates of birth must be completed. If they do not have eligible family members at the time of enrollment, they can request the coverage without providing evidence of insurability by applying to MEBP within 31 day of the date that a spouse and/or child(ren) are acquired.

- Beneficiary Designation – This section is to designate the Primary and/or Secondary beneficiaries for the Basic Life and Optional Life Insurance (if participating). A member may designate any beneficiary(ies) they choose. Percentages must add up to 100%. NOTE: The death benefit would only be paid to the Secondary Beneficiary(ies) if all of the Primary Beneficiaries were pre-deceased at the time of the member's death

- The beneficiary will be the same for both the Basic Life and the Optional Life Insurance unless otherwise indicated. If a different beneficiary designation is to be made for the Optional Life Insurance that has been applied for, then please have the employee complete a BLUE CROSS/MEBP Group Life Insurance Beneficiary Designation Form for the Optional Life Insurance designation and indicate as such on this form.

- A Trustee should be named for any minor beneficiary or a beneficiary that lacks legal capacity. The employee must sign and date this section.

- To Be Completed By Employer Section:

- Name of Employer

- Employer Number

- Employee Class Life – MEBP will complete this area

- Occupation - provide employee's occupation

- Date Employed - first day of work

- Total Yearly Coverage Amount $ - indicate the total amount of Basic Life Coverage the Employee has applied for

- Completed for Employer by - Employer must sign and date this area

- Please do not send any forms directly to Blue Cross. All forms are to be sent to the MEBP Administration Office.

Eligible Family Member

Family Life Insurance offers life insurance coverage on the lives of the Member’s eligible family members.

Eligible family members are:

Spouse/Common Law Partner This is a person who is legally married to the Member or has continuously lived with the Member for not less than 1 full year having been represented as members of a common-law relationship. The Member can only cover ONE spouse or common-law partner at a time.

Children: This is a person(s) who is the Member’s natural, adopted, stepchildren or any other children for whom the Member and his/her Spouse/Common –Law Partner have been appointed as a guardian. Children must be dependent on the Member for financial care and support and must be:

- Unmarried,

- Unemployed, and

- Less than 19 years of age; or if 19 years of age but less than 25 years of age, they must be attending an accredited educational institution, college, or university on a full-time basis.

The children of the Member’s common-law spouse will be covered if they are living with the Member.

Unmarried, unemployed children over the 19 years of age will qualify if they are dependent on the Member by reason of a mental or physical disability and have been continuously so disabled since the age of 19.

Unmarried, unemployed children who became totally disabled while attending an accredited education institution, college or university on a full-time basis prior to their attaining age 24 and have been continuously so disabled since that time shall also qualify as a dependent.

The Member may be required to provide confirmation that the child is a full-time student, remains dependent on the Member for support and maintenance or that the child is not capable of self-support due to a disability.

Dependents Exclude:

- Any Spouse residing outside of Canada, or

- Any person for whom Evidence of Insurability, if required, has not been approved by the insurance carrier.

If both parents are Members of the MEBP Group Insurance Plan, they can both have coverage on the same child if they are both paying FAMILY LIFE contributions.

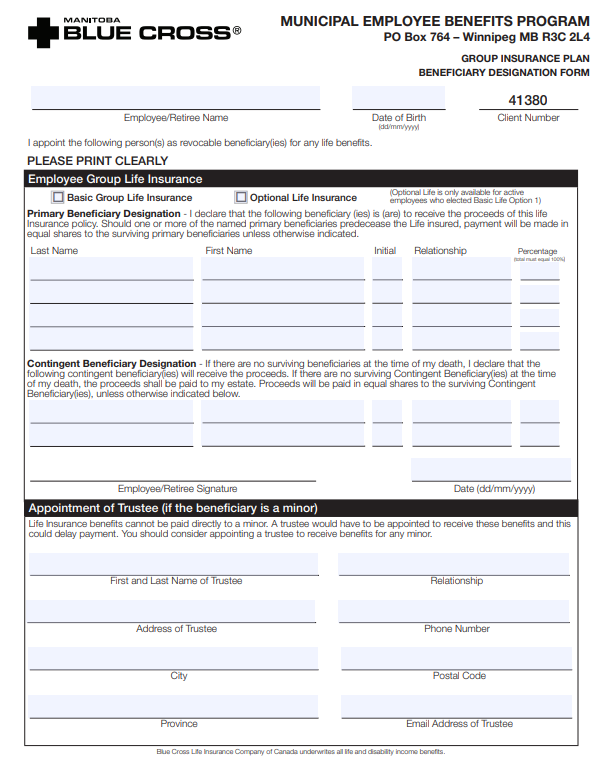

MBCbendesignation - BLUE CROSS/MEBP Group Life Insurance Beneficiary Designation Form

Please only complete this form if the employee has elected Option Life Insurance on the MBCAPP - Blue Cross/MEBP – Individual application for Group Insurance Plan form and wishes to designate a different beneficiary arrangement for Optional Life.

- Enter Employee Name and Date of birth.

- Select the Optional Life insurance Box.

- Beneficiary Designation – This section is to designate the Primary and/or Contingent beneficiaries for the Insurance Coverage selected. A member may designate any beneficiary(ies) they choose. Percentages must add up to 100%.

- Appointment of Trustee: This is to be filled out by the employee if any of the beneficiaries listed are under the age of 18 or lack legal capacity.

- The employee must sign and date the form.

NOTE: The death benefit would only be paid to the Contingent Beneficiary(ies) if all of the Primary Beneficiaries were pre-deceased at the time of the member's death

Mail this form to the MEBP Office along with the other Enrollment forms. Please do not send any forms directly to Blue Cross.

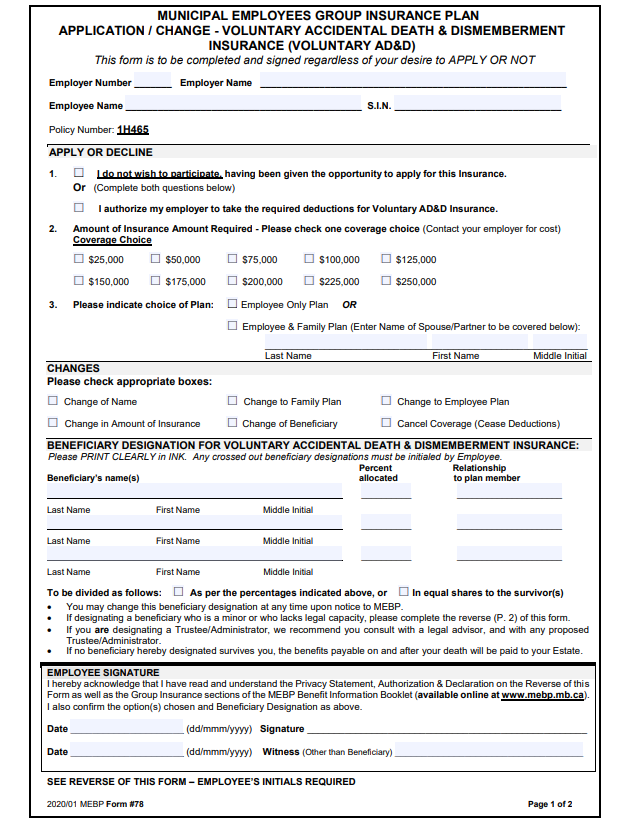

Form #78 - Application /Change-Voluntary Accidental Death & Dismemberment Insurance

This form must be completed even if the new employee does not want to participate, as it verifies awareness of the coverage.

- Employer Number: Enter the Employer number assigned to you by MEBP. It is used for identification purposes.

- Employer Name: Enter the Name of Employer

- Employee Name and Social Insurance Number: To be completed by the Employee. MEBP uses the Social Insurance Number when processing some transactions.

- Apply or Decline:

- The employee will check off the appropriate box indicating whether or not they want this additional voluntary insurance coverage.

- The employee is to select the amount of coverage they desire (select only one amount).

- The employee chooses which Plan, Employee Only OR Employee & Family Plan. If Employee & Family Plan is elected, list the name of their Spouse/Partner to be covered.

- Changes: This section does not need to be completed on original enrollment.

- Beneficiary Designation – This section is to designate the beneficiary arrangement for the Insurance Plan selected. A member may designate any beneficiary(ies) they choose Percentages must add up to 100%.

- To be divided as follows: Select the appropriate box.

- Employee Signature: The employee must sign and date the form.

- A Witness must also sign and date the form. The Witness on this form must be at least 18 years of age and cannot one of the beneficiaries listed.

- Trustee Appointment (page 2): This is to be filled out by the employee if any of the beneficiaries listed are under the age of 18 or lack legal capacity.

All areas of the form must be completed.

THIS IS A 2 PAGE FORM. After the front is completed, the employee is to read, complete and sign the page 2.

Mail this form to the MEBP Office along with the other Enrollment forms.